Ultimate Personal Budget is more than just a spreadsheet—it’s your personal game plan for financial peace of mind. When you know exactly where your money goes, you gain the power to take control and make it work for you.

Creating a budget that fits your lifestyle doesn’t mean cutting out everything fun. It means being intentional, staying aware of your goals, and building habits that actually stick—without feeling restricted.

If you’re ready to stop guessing and start mastering your money with confidence, you’re in the right place. Let’s dive into what makes a budget really work.

Understanding Personal Budgeting

Understanding personal budgeting is the foundation for achieving financial freedom. A personal budget helps you manage your income and expenses effectively, allowing you to allocate funds where they are needed most.

What is a Personal Budget?

A personal budget is a plan that outlines how you will spend your money over a certain period, typically on a monthly basis. It takes into account your income sources, fixed and variable expenses, and savings goals. By having a clear picture of your finances, you can make informed decisions.

Why is Personal Budgeting Important?

Budgeting is essential for several reasons. First, it helps you track spending, ensuring you don’t spend more than you earn. Second, it enables you to save for important goals, such as buying a house or planning a vacation. Finally, having a budget can reduce financial stress and help you manage unexpected expenses.

Components of a Personal Budget

A complete personal budget typically includes the following elements:

- Income: All sources of money, including salary, bonuses, and side jobs.

- Fixed Expenses: Regular payments that do not change, like rent or mortgage, insurance, and utilities.

- Variable Expenses: Costs that can change monthly, such as groceries, entertainment, and dining out.

- Savings and Investments: Allocations for future needs, including retirement accounts and emergency funds.

By understanding these components, you can create a balanced budget that reflects your financial situation.

Key Components of an Ultimate Personal Budget

Creating an ultimate personal budget involves understanding its key components. These elements ensure that your budget is comprehensive and effective in managing your finances.

1. Income

Your total income is the foundation of your budget. This includes your salary, bonuses, freelance income, and any passive income sources. Knowing your total income helps you determine how much you can spend and save.

2. Fixed Expenses

Fixed expenses are your regular payments that stay the same each month. Common fixed expenses include rent or mortgage, insurance premiums, and subscription services. It’s crucial to list these out so you can plan for them accurately.

3. Variable Expenses

Variable expenses fluctuate and can vary month to month. This category includes groceries, gas, entertainment, and dining out. Tracking these expenses helps you identify areas where you can cut back if necessary.

4. Savings Goals

Setting savings goals is vital for financial stability. These can include short-term goals like a vacation or long-term goals such as retirement savings. Allocate a specific amount each month toward these goals to ensure you are prepared for the future.

5. Debt Repayment

If you have debts, including credit card debt or loans, setting aside funds for repayment is essential. Prioritize high-interest debts to reduce overall interest paid.

6. Emergency Fund

An emergency fund is crucial for unexpected expenses. Aim to save at least three to six months’ worth of living expenses to cover emergencies and protect your budget.

7. Review and Adjust

Finally, regularly reviewing your budget allows you to make necessary adjustments. Financial situations can change, so it’s important to update your budget to reflect your current circumstances.

By including these key components, your ultimate personal budget will provide a solid foundation for achieving financial freedom.

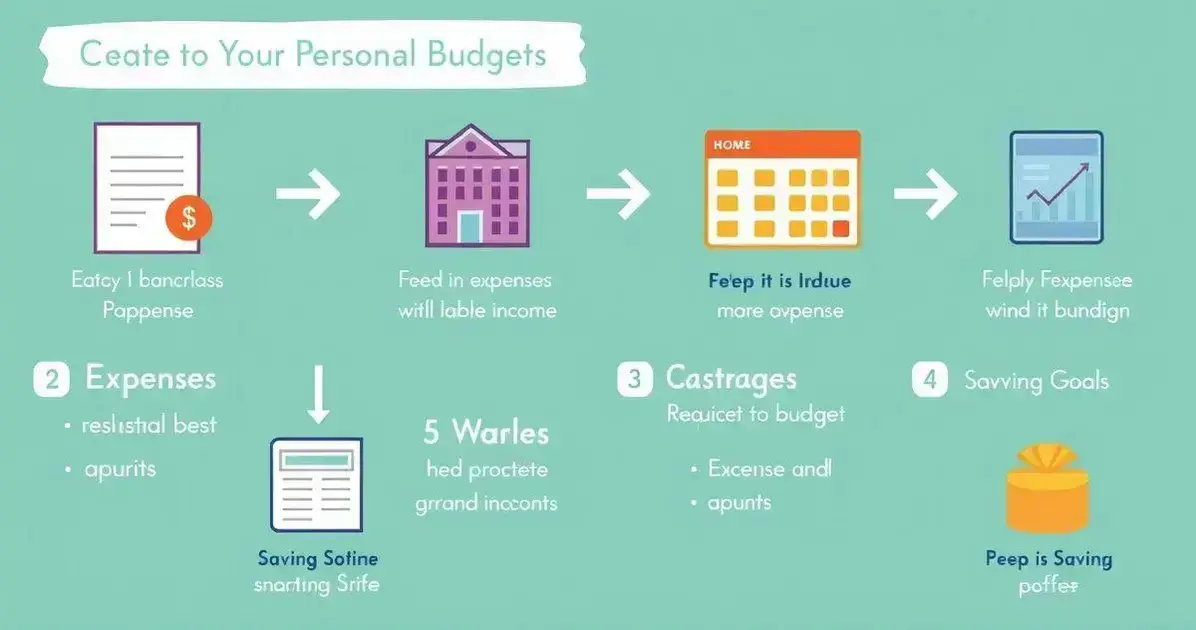

Steps to Create an Ultimate Personal Budget

Creating an ultimate personal budget involves several steps that guide you toward effective financial management. Follow these steps to build a budget that works for you.

1. Gather Your Financial Information

Begin by collecting all necessary financial documents. This includes pay stubs, bank statements, bills, and any other sources of income or expenses. Having a complete overview is vital for accurate budgeting.

2. Identify Your Income

Determine your total monthly income. Include your salary, side gigs, and any other income streams. This figure is your starting point for creating your budget.

3. List Your Expenses

Make a detailed list of all your monthly expenses. Break them down into two categories: fixed and variable expenses. Fixed expenses are set amounts, like rent or mortgage payments, while variable expenses can fluctuate.

4. Set Savings Goals

Decide how much you want to save each month. Consider both short-term goals (like vacations) and long-term goals (like retirement). Setting these goals will help prioritize your spending.

5. Create Your Budget

Using the income and expense data, create your budget. Allocate specific amounts to each expense category and savings goal. Make sure your total expenses do not exceed your income.

6. Track Your Spending

Monitor your expenses regularly to ensure you stick to your budget. Use tools like spreadsheets, budgeting apps, or simple pen and paper to keep track of your spending.

7. Review and Adjust

At the end of each month, review your budget. Analyze where you succeeded and where you fell short. Make adjustments as necessary to better fit your financial situation for the next month.

Tracking Expenses Effectively

Tracking expenses effectively is a crucial part of maintaining a personal budget. By keeping close tabs on where your money goes, you can make smarter financial decisions.

1. Choose the Right Method

There are various methods to track expenses. You can use budgeting apps, spreadsheets, or even a simple notebook. Choose what works best for you based on your comfort level and needs.

2. Categorize Your Expenses

Organize your expenses into categories such as housing, transportation, food, entertainment, and savings. This will help you see patterns in your spending and identify areas for improvement.

3. Record Transactions Promptly

To avoid forgetting about small purchases, record transactions right away. Either jot them down immediately or use a mobile app to track your spending on the go. This practice helps maintain accuracy in your budget.

4. Review Weekly

Set aside time each week to review your expenses. Look for any unexpected charges or areas where you overspent. Weekly reviews can help you stay accountable and adjust your spending habits as needed.

5. Analyze Monthly Trends

At the end of each month, analyze your spending trends. Compare your budgeted amounts with your actual expenditures. This will help you understand your financial behavior and identify any necessary adjustments.

6. Utilize Technology

Many budgeting apps can automate expense tracking. These tools can categorize transactions and provide insights into your spending habits. Consider using apps like Mint, YNAB (You Need A Budget), or Personal Capital.

7. Stay Consistent

Consistency is key in tracking your expenses. Make it a daily habit to record your expenses, review them regularly, and adjust your budget as needed. Over time, you will become more aware of your financial habits.

Tools for Managing Your Budget

Managing your budget effectively can be greatly enhanced by using the right tools. Here are some valuable tools that can simplify budgeting and financial management.

1. Budgeting Apps

Budgeting apps are popular for their convenience. Apps like Mint allow you to connect your bank accounts, track spending, and create budgets all in one place. You can also get alerts for bills and plan your savings.

2. Spreadsheet Software

If you prefer a more hands-on approach, consider using spreadsheet software like Microsoft Excel or Google Sheets. They provide customizable templates where you can enter your income and expenses, making it easy to visualize your budget.

3. Pen and Paper

Some people find writing things down helps them remember better. Using a simple notebook to log your expenses and income can be effective. Create sections for different categories to keep it organized.

4. Expense Trackers

Expense tracker tools, such as You Need A Budget (YNAB), focus specifically on tracking spending. These tools emphasize proactive budgeting, helping you allocate every dollar before you spend it.

5. Financial Management Software

For those looking for a comprehensive solution, financial management software like Quicken offers robust features. It enables you to manage investments, track expenses, and prepare for taxes all in one program.

6. Online Resources and Blogs

Many websites offer budgeting templates, tips, and resources. Bookmark blogs and websites dedicated to personal finance for ongoing education and additional tools you might find useful.

7. Community Support

Joining budgeting groups or forums can provide motivation and accountability. Online communities can share their experiences, tips, and tools that have worked for them, helping you stay on track with your budget.

Adjusting Your Budget Over Time

Adjusting your budget over time is an essential part of effective financial management. Life changes and unexpected events can impact your financial situation, and being flexible with your budget will help you stay on track.

1. Regularly Review Your Budget

Set a specific time each month to review your budget. Look at your income and expenses and see where adjustments are needed. Regular reviews allow you to stay aware of your financial situation and make timely changes.

2. Respond to Life Changes

Life events, such as a new job, a move, or changes in family size, can significantly affect your budget. When such changes happen, reassess your financial goals and update your budget accordingly to reflect these new realities.

3. Adjust for Unforeseen Expenses

If unexpected expenses arise, such as medical bills or car repairs, you may need to adjust your budget to cover these costs. Consider temporarily reducing spending in other areas to accommodate these unplanned expenses.

4. Update Savings Goals

Your savings goals may change over time. For example, you might want to save for a home or a vacation. Regularly update these goals in your budget to ensure you are putting money aside for what is most important to you.

5. Track Your Progress

Keep track of your financial progress toward your budget and goals. Use tools like budgeting apps or spreadsheets to visualize how well you are sticking to your plan. Adjust your budget based on this progress to stay motivated.

6. Set New Financial Goals

As you reach certain financial milestones, set new goals. Whether it’s saving more, reducing debt, or investing, adjusting your budget to reflect these new goals encourages continual growth.

7. Maintain Flexibility

Lastly, remember that budgets are not meant to be set in stone. Be open to making adjustments as needed. Flexibility allows you to adapt to changing circumstances without feeling overwhelmed.

Common Budgeting Mistakes to Avoid

Avoiding common budgeting mistakes can help you manage your finances better. Here are some pitfalls to watch out for:

1. Not Tracking Expenses

One of the biggest mistakes is failing to track where your money goes each month. Without tracking, you may overspend without realizing it. Always keep a record of all your expenses.

2. Setting Unrealistic Goals

While it’s good to be ambitious, setting unrealistic financial goals can lead to frustration. Set achievable and specific savings targets to help you stay motivated without overwhelming yourself.

3. Ignoring Irregular Expenses

It’s easy to forget or ignore expenses that don’t occur weekly or monthly, like annual fees or occasional maintenance costs. Include these in your budget to avoid surprises later on.

4. Being Too Restrictive

Creating a budget that is too strict can reduce your chances of sticking to it. Allow some flexibility for fun or leisure spending to avoid feeling deprived.

5. Failing to Adjust Your Budget

As your financial situation changes, so should your budget. Failing to adjust for life changes, such as a new job or rising costs, can make your budget ineffective.

6. Not Including Savings

Many people forget to include savings in their budgets. Treat savings like a regular expense, setting aside a portion of your income for future needs or emergencies.

7. Overlooking Small Purchases

Small purchases can add up quickly. Whether it’s coffee runs or snacks, these minor expenses can eat into your budget. Track all spending, no matter how small.

8. Forgetting About Debt Repayment

Not planning for debt repayment can lead to financial trouble. Make sure to allocate funds each month for any debts you owe, keeping your budget balanced.

FAQ – Frequently Asked Questions About Budgeting

What are the key components of a personal budget?

The key components include income, fixed expenses, variable expenses, savings goals, debt repayment, and an emergency fund.

How can I effectively track my expenses?

You can track expenses by using budgeting apps, spreadsheets, or even pen and paper. Regularly recording transactions and reviewing them helps maintain accuracy.

What tools can I use to manage my budget?

Popular tools include budgeting apps like Mint and YNAB, spreadsheet software like Excel or Google Sheets, and even simple notebooks for tracking expenses.

Why is it important to adjust my budget over time?

Adjusting your budget is crucial as life circumstances change. Regular updates help you respond to new financial situations and stay aligned with your goals.

What common budgeting mistakes should I avoid?

Common mistakes include not tracking expenses, setting unrealistic goals, ignoring irregular expenses, and failing to adjust your budget for changes.

How often should I review my budget?

It’s advisable to review your budget monthly. This allows you to make necessary adjustments and stay on track with your financial goals.