How to Assess Financial Risk is more than just a technical task—it’s a crucial mindset for anyone who wants to grow their money without losing sleep. Whether you’re a seasoned investor or just getting started, understanding what can go wrong is key to making things go right.

Every financial move comes with a level of uncertainty. Ignoring risk doesn’t make it disappear; it just leaves you unprepared when it shows up. Assessing risk the right way helps you stay in control, even when markets get shaky.

If you’re serious about protecting your money and making smarter choices, you’re in the right place. Keep reading to learn how to turn risk into your financial advantage.

Understanding Financial Risk

Understanding financial risk is essential for anyone looking to make informed decisions regarding investments and financial planning. Financial risk can be defined as the possibility of losing money or not achieving the expected returns. It encompasses various uncertainties that can impact an investment’s performance and should be considered by investors of all backgrounds.

Importance of Recognizing Financial Risk

By recognizing financial risks, individuals and organizations can strategize effectively to protect their investments. Understanding potential pitfalls leads to better financial decisions and a more secure financial future.

Components of Financial Risk

Financial risk includes several components such as market risk, credit risk, liquidity risk, and operational risk. Market risk arises from fluctuations in market prices, credit risk involves the chance that a borrower may default, liquidity risk refers to financial difficulties in quickly turning assets into cash, and operational risk involves losses due to failed processes or systems.

How Financial Risks Affect Investments

These components can significantly affect the success of an investment. For example, if a company faces a high level of market risk and experiences a downturn, investors may suffer losses. Understanding how these risks can impact one’s portfolio aids in developing effective strategies to mitigate these issues.

Managing Financial Risk

Effective management of financial risks involves identifying potential risks, assessing their impacts, and implementing strategies to minimize or eliminate them. This can include diversifying investment portfolios, setting risk limits, and utilizing financial instruments designed to hedge against potential losses.

Conclusion

Ultimately, understanding financial risk is a vital step in mastering effective financial evaluation. Regularly assessing the risks associated with investments not only helps in safeguarding assets but also enhances decision-making capabilities.

Identifying Types of Financial Risks

Identifying types of financial risks is a critical part of understanding how to assess them effectively. Financial risks can be categorized into several distinct types, each with specific characteristics and implications for investors.

Market Risk

Market risk refers to the potential for losses due to changes in market conditions. This can include stock price fluctuations, interest rate changes, and shifts in currency values. Investors need to be aware of market trends to mitigate these risks.

Credit Risk

Credit risk is the possibility that a borrower will default on a loan or obligation, affecting an investor’s returns. This risk is most commonly associated with bond investments, where the issuer may fail to make scheduled interest payments.

Liquidity Risk

Liquidity risk occurs when an investor cannot quickly buy or sell an asset without significantly affecting its price. This often happens in markets with lower trading volumes, making it essential to understand the liquidity profiles of investments.

Operational Risk

Operational risk arises from failures in a company’s internal processes, people, or systems. This includes risks related to management failures, fraud, or technology breakdowns that can impact financial health.

Legal and Regulatory Risk

Legal and regulatory risk stems from changes in laws and regulations that may affect investments. This could include new government regulations, litigation risks, or changes in tax policies that could influence financial returns.

Reputational Risk

Reputational risk refers to the potential loss of reputation that can impact a company’s revenues or stakeholder relationships. This can arise from negative publicity, fraud, or failure to meet compliance standards.

Environmental Risk

Environmental risk includes the financial impact that can arise from environmental factors, such as natural disasters or changes in environmental policies. This risk is becoming increasingly important for investors to consider in a world increasingly affected by climate change.

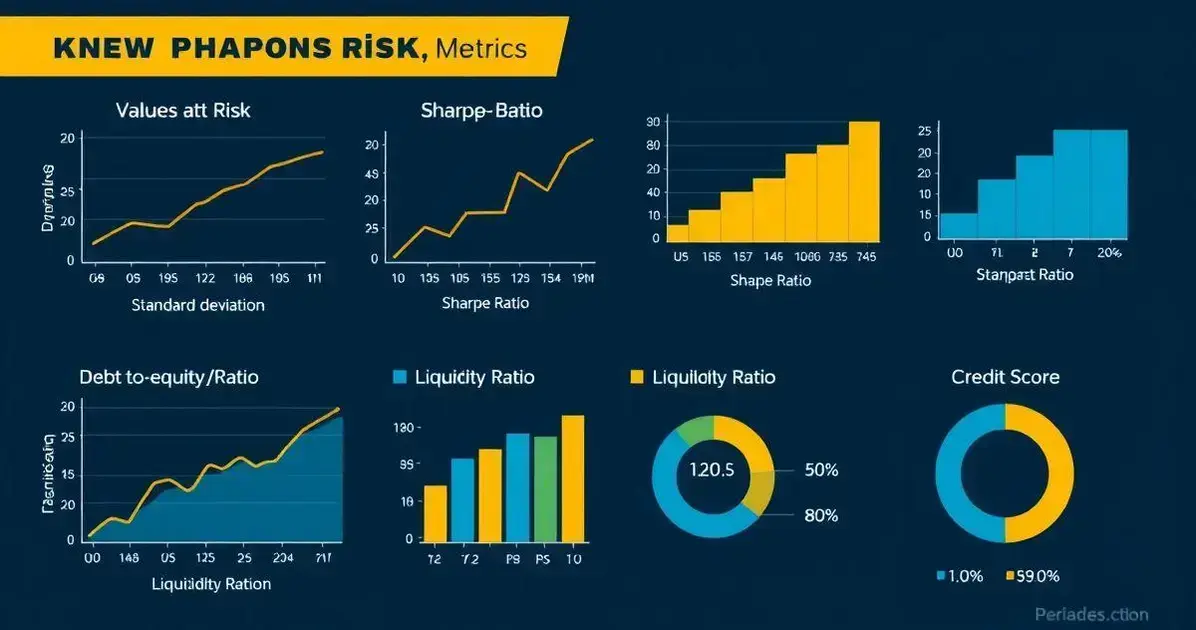

Key Metrics for Financial Risk Assessment

When assessing financial risk, it is crucial to utilize key metrics that provide insights into potential vulnerabilities and overall financial health. These metrics can help investors make informed decisions and manage risks effectively.

Value at Risk (VaR)

Value at Risk is a statistical measure used to assess the potential loss on an investment portfolio over a specified period for a given confidence interval. It quantifies the worst-case scenario and gives investors a clear idea of the maximum expected loss.

Standard Deviation

The standard deviation measures the dispersion or volatility of investment returns. A higher standard deviation indicates greater variability and, therefore, higher risk. Investors can use this metric to gauge how much an asset’s return might fluctuate.

Beta

Beta is a measure of an investment’s volatility in relation to the overall market. A beta greater than 1 indicates that the asset is more volatile than the market, while a beta less than 1 indicates lower volatility. This metric helps investors understand the risk associated with market movements.

Sharpe Ratio

The Sharpe ratio assesses the risk-adjusted return of an investment by comparing its excess return to its volatility. A higher ratio indicates a more favorable risk-return trade-off, which is important for evaluating mutual funds and assets.

Debt-to-Equity Ratio

The debt-to-equity ratio measures a company’s financial leverage by comparing its total debt to its shareholders’ equity. A higher ratio indicates more risk, as it shows that a company relies more on debt for financing, which can affect its financial stability.

Liquidity Ratio

The liquidity ratio, including current and quick ratios, assesses a company’s ability to cover its short-term liabilities. A strong liquidity position indicates lower financial risk, as the company can meet its obligations promptly.

Credit Score

For individuals and companies, a credit score reflects the likelihood of defaulting on repayments. A higher score indicates lower credit risk, making it easier to secure loans or favorable interest rates. Understanding your credit score can be key to managing financial risk.

Tools for Assessing Financial Risk

To effectively assess financial risk, various tools can be employed to analyze and manage potential uncertainties. Here are some essential tools that help in assessing financial risk:

Financial Risk Assessment Software

Specialized software can provide comprehensive analytics of financial data. Programs like RiskAssessmentPro or QuantRisk are designed to evaluate possible financial scenarios, helping businesses to identify their risk exposure quickly.

Scenario Analysis Tools

Scenario analysis tools allow users to project different financial outcomes based on varying conditions. These tools enable investors to visualize how changes in market factors can impact their investments.

Monte Carlo Simulation

The Monte Carlo simulation is a mathematical technique that uses random sampling to assess risk. By simulating thousands of possible outcomes, it helps in understanding risks better and making informed decisions.

Credit Risk Management Tools

Tools specifically for assessing credit risk, such as FICO Score and CreditRiskMonitor, provide insights into the creditworthiness of individuals or companies, helping investors to gauge potential repayment risks.

Portfolio Management Systems

Portfolio management systems like Morningstar or Bloomberg allow investors to track their investments and assess associated risks over time. These platforms often include tools for diversification analysis and performance tracking.

Financial Modeling Software

Financial modeling tools, such as Excel with specialized plugins or software like Tableau, enable users to create financial models that assess potential risks and returns based on historical data.

Online Financial Calculators

Simple online calculators can help estimate various financial metrics, such as loan risks, return on investment, and rate changes. These tools provide quick insights and can aid in preliminary risk assessments.

Common Mistakes in Financial Risk Evaluation

Evaluating financial risk is a complex process, and there are several common mistakes that can lead to misleading conclusions. Identifying these mistakes is key to improving the evaluation process.

Overlooking External Factors

Many evaluators fail to consider external factors such as economic conditions, geopolitical events, and market trends. These external factors can significantly impact financial performance and should not be ignored.

Neglecting Historical Data

Not using historical data can lead to poor risk assessment. Historical performance provides valuable insights into how investments might react under different market conditions. Relying solely on projections without historical context may result in a skewed risk assessment.

Focusing Only on Short-Term Risks

Evaluating only short-term risks can be a mistake. Long-term risks, such as climate change or regulatory changes, can have profound effects on financial performance. A comprehensive evaluation must include both short-term and long-term perspectives.

Ignoring Diversification

Investors sometimes overlook the importance of diversification. Concentrating too heavily on one asset or sector increases risk. A well-diversified portfolio can reduce overall risk exposure and improve stability.

Misunderstanding Financial Metrics

Using financial metrics incorrectly can lead to misinterpretation of risk. It’s critical to understand what each metric indicates and how it relates to others. For example, confusing liquidity ratios with profitability ratios can distort risk perceptions.

Using Outdated Tools

Relying on outdated tools or methods for risk assessment can limit effectiveness. Financial markets evolve rapidly, and using modern assessment tools ensures that evaluations are based on current data and technologies.

Failing to Review and Update Assessments

Risk assessments should not be static. Regular reviews and updates are essential to reflect the changing environment and conditions. Failure to revisit assessments can lead to outdated strategies that do not account for new risks.

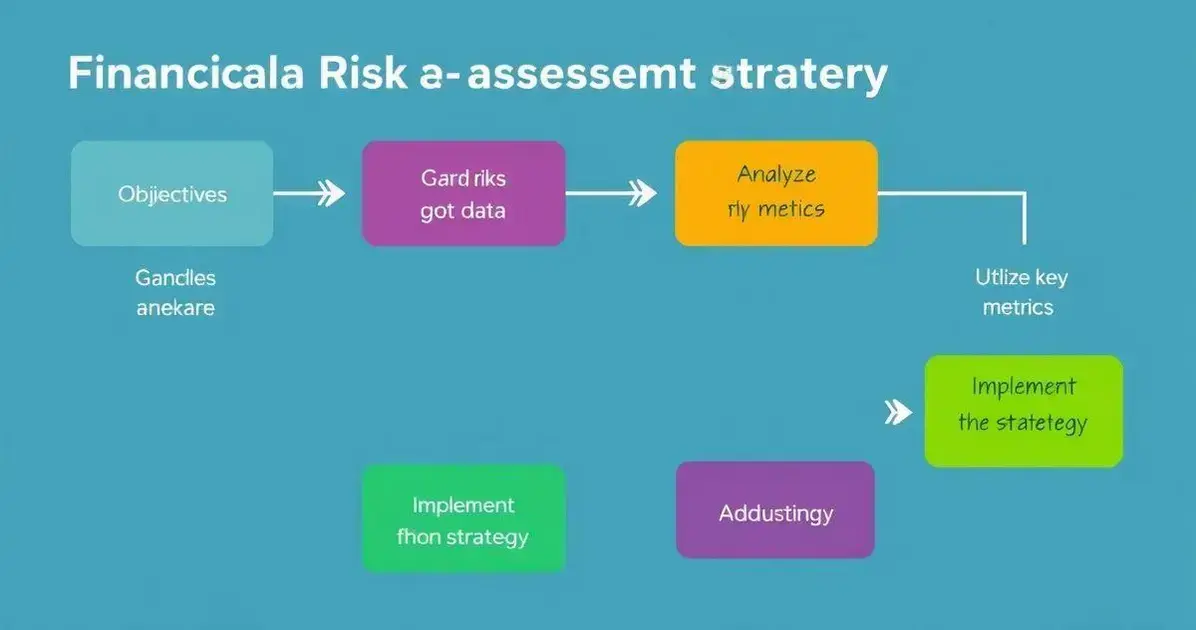

Developing a Financial Risk Assessment Strategy

Developing a financial risk assessment strategy is essential for making informed decisions. Here are the steps involved in creating an effective strategy:

Identify Objectives

The first step is to identify the specific objectives of your financial risk assessment. Consider what you want to achieve, whether it’s protecting assets, improving returns, or ensuring compliance with regulations.

Gather Data

Collect relevant data on your investments, market conditions, and economic indicators. Reliable data is crucial for accurately assessing risks. This data will also help in understanding past performance and future projections.

Analyze Risks

Using the data gathered, identify and analyze potential risks to your financial portfolio. Consider the various types of risks, such as market risk, credit risk, and operational risk. Understanding these risks helps in formulating mitigation strategies.

Utilize Key Metrics

Employ key metrics like Value at Risk (VaR), standard deviation, and Sharpe ratio to quantify the risks involved. These metrics provide a clearer understanding of the risk levels associated with investments.

Develop Mitigation Strategies

Based on your analysis, develop strategies to mitigate identified risks. This could involve diversifying your investment portfolio, utilizing hedging techniques, or setting risk limits to safeguard your assets.

Implement the Strategy

Once your strategy is developed, the next step is to implement it effectively. Ensure that all stakeholders are informed and trained regarding their roles in managing financial risks.

Review and Adjust

Regularly review and adjust your financial risk assessment strategy based on new data, market changes, and performance evaluations. Continuous improvement is vital to adapt to evolving financial landscapes.

FAQ – Frequently Asked Questions about How to Assess Financial Risk

What is financial risk assessment?

Financial risk assessment is the process of identifying, analyzing, and managing potential risks that could negatively impact an investment or financial decision.

What are the key types of financial risks?

The key types of financial risks include market risk, credit risk, liquidity risk, operational risk, legal and regulatory risk, reputational risk, and environmental risk.

What metrics should I use for assessing financial risk?

Key metrics for assessing financial risk include Value at Risk (VaR), standard deviation, beta, Sharpe ratio, debt-to-equity ratio, liquidity ratio, and credit score.

What tools are helpful in financial risk assessment?

Useful tools for financial risk assessment include risk assessment software, scenario analysis tools, Monte Carlo simulations, portfolio management systems, and online financial calculators.

What common mistakes should I avoid in financial risk evaluation?

Common mistakes include overlooking external factors, neglecting historical data, focusing only on short-term risks, misunderstanding financial metrics, and using outdated tools.

How can I develop a financial risk assessment strategy?

To develop a financial risk assessment strategy, identify your objectives, gather data, analyze risks, utilize key metrics, develop mitigation strategies, implement the strategy, and regularly review it.